Bitcoin is dead (to tourists)

Anyone who has been paying attention to bitcoin for a full market cycle is familiar with the Bitcoin Obituaries site that tracks the 450+ times that the death of the project has been declared prematurely. Why do pundits and journalists continue to repeat this simple mistake for over a decade?

Unfortunately, few folks track bitcoin's health any deeper than its exchange rate. Thus they incorrectly assume that when the rate decreases, the ecosystem is dying... and we end up with tongue-in-cheek gems like this:

Those of us for have seen a few cycles know better.

If the Bitcoiners you follow only talk about price speculation, they're probably not Bitcoiners. They're likely high time preference traders who are actually seeking more fiat.

— Jameson Lopp (@lopp) September 18, 2021

Defining death

If Bitcoin is a new form of life:

— Jameson Lopp (@lopp) February 4, 2019

* Electricity is its food

* The Internet is its circulatory system

* Miners are its hearts

* Blocks are the heartbeats

* Full nodes are the white blood cells

* Human participants are the brain cells

I posit that as long as bitcoin's "heart" is still beating and blocks are circulating, the network is "alive" — AKA it is operational.

If you read the whitepaper, you may note that none of the system's operations have any inputs or understanding of fiat exchange rates. Of course the exchange rate can affect miners and businesses on top of the network, but the network itself is ambivalent as to the value that humans have assigned to it.

"This time is different"

While it's true that each market cycle tends to come with new narratives, use cases, and reasons for speculation, the booms and busts tend to rhyme. During the mania phase, many new entrants take new types of risks up to the point that the market can no longer support them, and then the market collapses back to a realistic level as expectations re-adjust. What are we seeing this cycle?

Yield generation custodians are facing insolvency and freezing withdrawals to stave off bank runs.

Companies that overextended themselves during the boom are cutting back.

Lenders who took on too much risk are blowing up or seeking bailouts.

Miners who speculated too heavily and built their businesses based on leverage are forced to liquidate their stash at unfavorable prices.

Free markets in action

While there's little doubt that pain, suffering, and losses have been endured by market participants lately, this is a healthy learning lesson.

Folks who built and invested in complex systems that obscured their actual weaknesses were rekt when the systems failed under stress.

Those who played unsustainable games with their capital have lost it as the market shed those risks.

Speculators who leveraged their capital in an attempt to multiply it have been liquidated.

Those who ignored the fundamental risk management principles of this ecosystem that have been learned over the past decade through countless loss events have now learned the hard way by being burned.

Throughout this entire saga, blocks continue being produced.

The fundamentals remain the same

Bitcoin as a system has proven itself quite resilient to all kinds of shocks. Just last year we saw its resilience to a nation-state level attack from the country hosting the majority of hashpower.

Bitcoin's network hashrate increased by 10% during 2021, from 159 to 175 exahash per second.

— Jameson Lopp (@lopp) January 2, 2022

But that's not noteworthy. Weathering and completely recovering from a 50%+ drop due to a mining ban by the country with the most hashpower was a major milestone for network resilience. pic.twitter.com/yw8HwXm9pG

In comparison, exchange rate volatility is not a factor to be worried about — other aspects of the system adjust to the exchange rate as needed.

There will be no mining death spiral; even if some miners are forced out of profitability and out of business, the mining difficulty will adjust until it finds equilibrium and the most efficient miners are profitable once again.

It should be clear to everyone by now that the "difficulty death spiral" predictions were merely hot air. https://t.co/3is1ieQ0rl

— Jameson Lopp (@lopp) January 1, 2018

Bitcoin is healing as investors who were chasing yield are doing the math and realizing that 105% of 0 is 0. As such, they are fleeing to the safety of self-custody.

1/

— JT (@jt_hodlnaut) June 19, 2022

Some updates on @hodlnautdotcom and hopefully to the CeFi borrowing and lending space and Contagion risks

Outflows, we have seen 150M of user withdrawals in the past 2 weeks. at current market prices, that is a net outflow of 35% of AUM

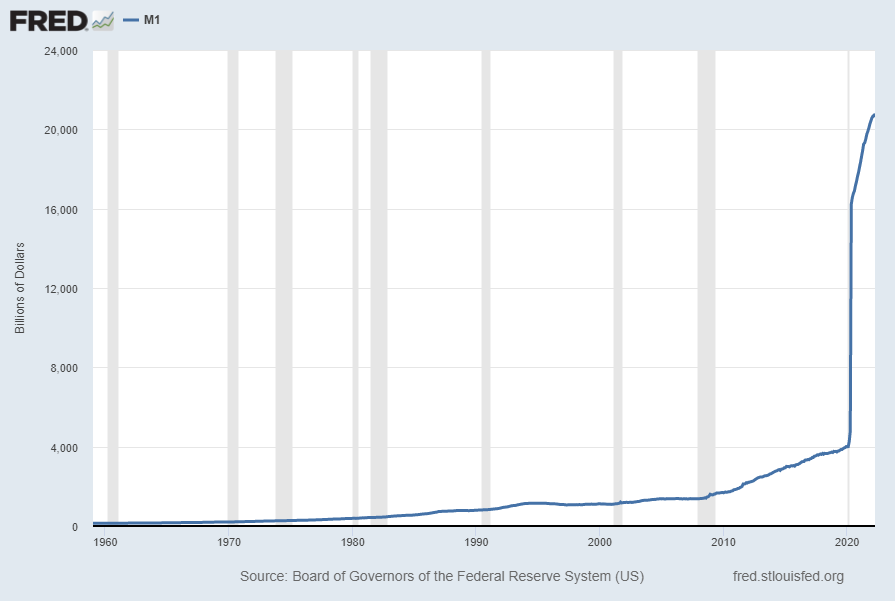

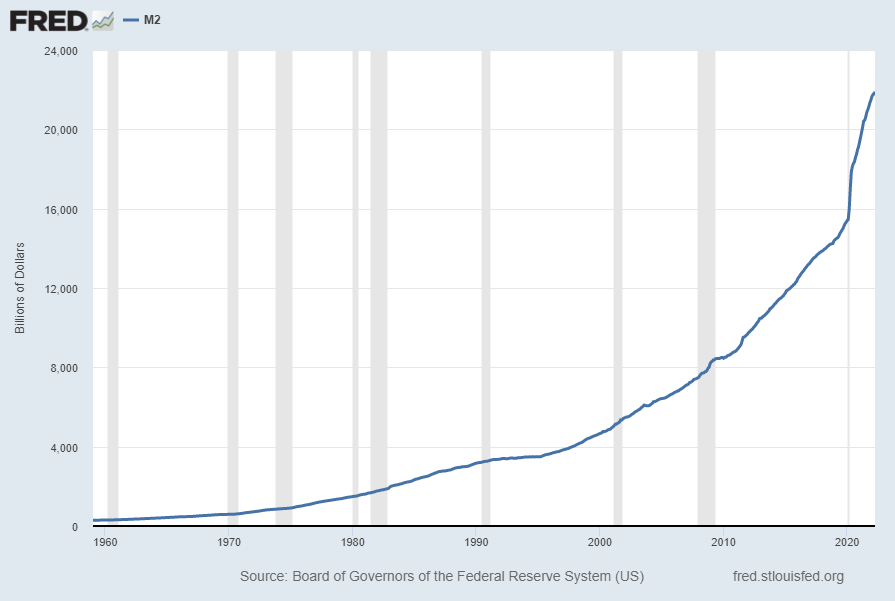

Fiat is doomed

On the other hand, it's hard to be optimistic about the long-term viability of systems controlled by central banks.

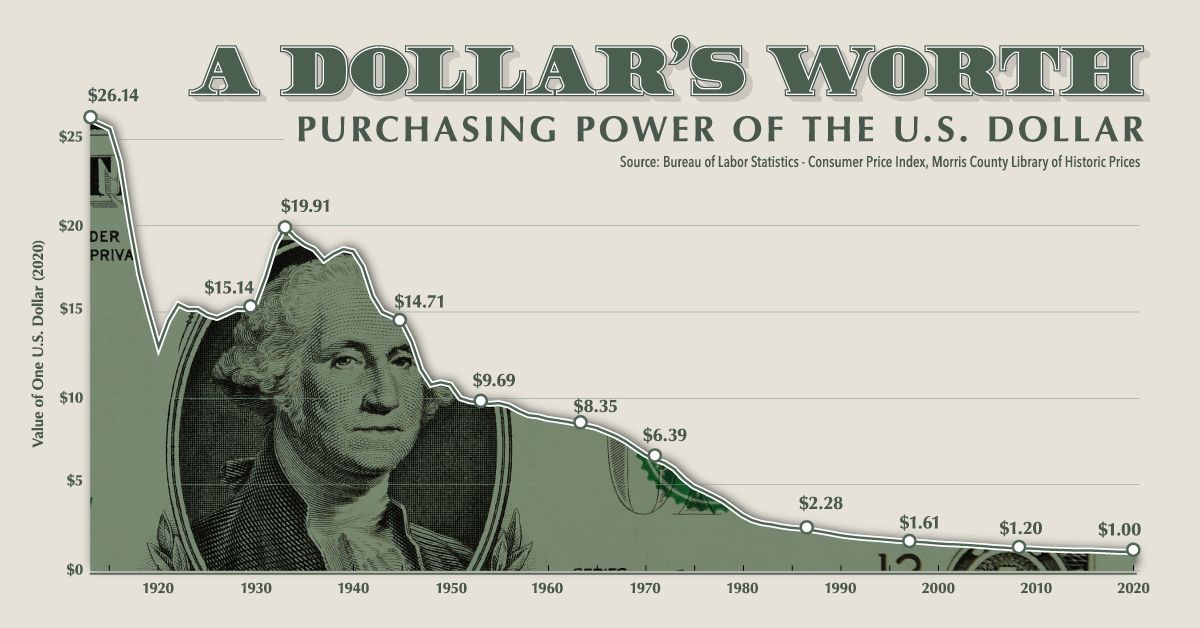

Bitcoin price charts are just noise.

— Jameson Lopp (@lopp) June 29, 2021

The signal is in the central bank charts.

The long-term trend looks quite clear.

Declaring Bitcoin's demise

The naïveté of outsiders and critics lets them believe they can declare the experiment to be over. But bitcoin is a distributed organism; it only dies when the humans who contribute resources to support it all decide to stop doing so.

@aantonop Bitcoin can't die merely from majority consensus that it is dead; it requires 100% consensus in order to produce Proof of Death.

— Jameson Lopp (@lopp) January 14, 2015

As a long-time contributor to this space, I am far from the point of declaring it unworthy of my resources.

They said to "only invest what you can afford to lose" so I only invested my retirement funds, my career, and my reputation. pic.twitter.com/niK9o2KpCk

— Jameson Lopp (@lopp) December 12, 2018

Want updates on bitcoin security?

Our Casa Security Briefing provides a weekly update on news + developments impacting your personal security and privacy. Sign up for free below.

Continue reading