Introducing Casa Enterprise: Hold your bitcoin treasury in self-custody

In March 2023, Silicon Valley Bank experienced a bank run. Businesses of all sizes that held their money with SVB scrambled over a weekend to get access to money and ensure they could make payroll on Monday. In that moment, many people experienced a bank run for the first time in their lives, realizing that not having control of their money can be a massive business tail risk.

We believe bitcoin will change the world as an asset you can truly own with keys only you control. Today, we’re inviting businesses along on that journey with Casa Enterprise.

This offering equips businesses with the tools they need to manage their bitcoin treasury in self-custody with nimble control and visibility.

The rise of bitcoin treasuries

When Casa started in 2018, bitcoiners were struggling to secure their private keys. Everyday people were getting hacked, coins were being lost, and custodians were falling short of their responsibility. We solved that problem by making multisig powerful yet easy to use.

Bitcoin adoption has crossed a chasm since then. The entry of MicroStrategy, Tesla, and other publicly traded companies holding bitcoin on their balance sheets marked a turning point in adoption. Today, public and private companies hold more than 400,000 BTC combined, and those are just the companies we know about. Now, business leaders and policymakers are discussing bitcoin as a strategic reserve.

Casa is quite familiar with the process of holding a bitcoin treasury — we’ve had our own since we began in 2018. When clients purchase a Casa membership with bitcoin, we HODL those sats, and we’ve strategically added to our treasury over the years.

Most importantly, we secure our treasury using our battle-tested multisig vault design and Wealth Security Protocol. This same approach protects billions of dollars in bitcoin for our clients. Today, Casa Enterprise can help businesses of all sizes hold a bitcoin treasury in self-custody while minimizing counterparty risk and ensuring organizational resilience.

Self-custody and fiduciary duty

One of the main concerns we’ve heard in talking to businesses over the years about holding bitcoin revolves around fiduciary duty. Fiduciary duty is the responsibility of company executives to properly manage the company and its finances.

We’ve consistently heard concern that to be within their fiduciary duty, company executives need to use a custodian. Holding your own keys introduces risk of loss, insider fraud, and theft.

We disagree with this position. In fact, given what we’ve seen over even the last few years with the implosions of FTX, BlockFi, Celsius, and the bank run on SVB, it’s clear that holding at least some of your bitcoin treasury in self-custody is part of exercising good judgment and upholding your fiduciary duty as an executive.

Part of fiduciary duty is protecting the company against risk. With the right tools that protect against loss, insider fraud, and theft, self custody properly protects your treasury against counterparty risk. Is it really better to trust a custodian’s black box processes than ones you’ve established yourself?

We’ve designed Casa Enterprise to eliminate the objections around holding your own keys and set the standard for business self-custody.

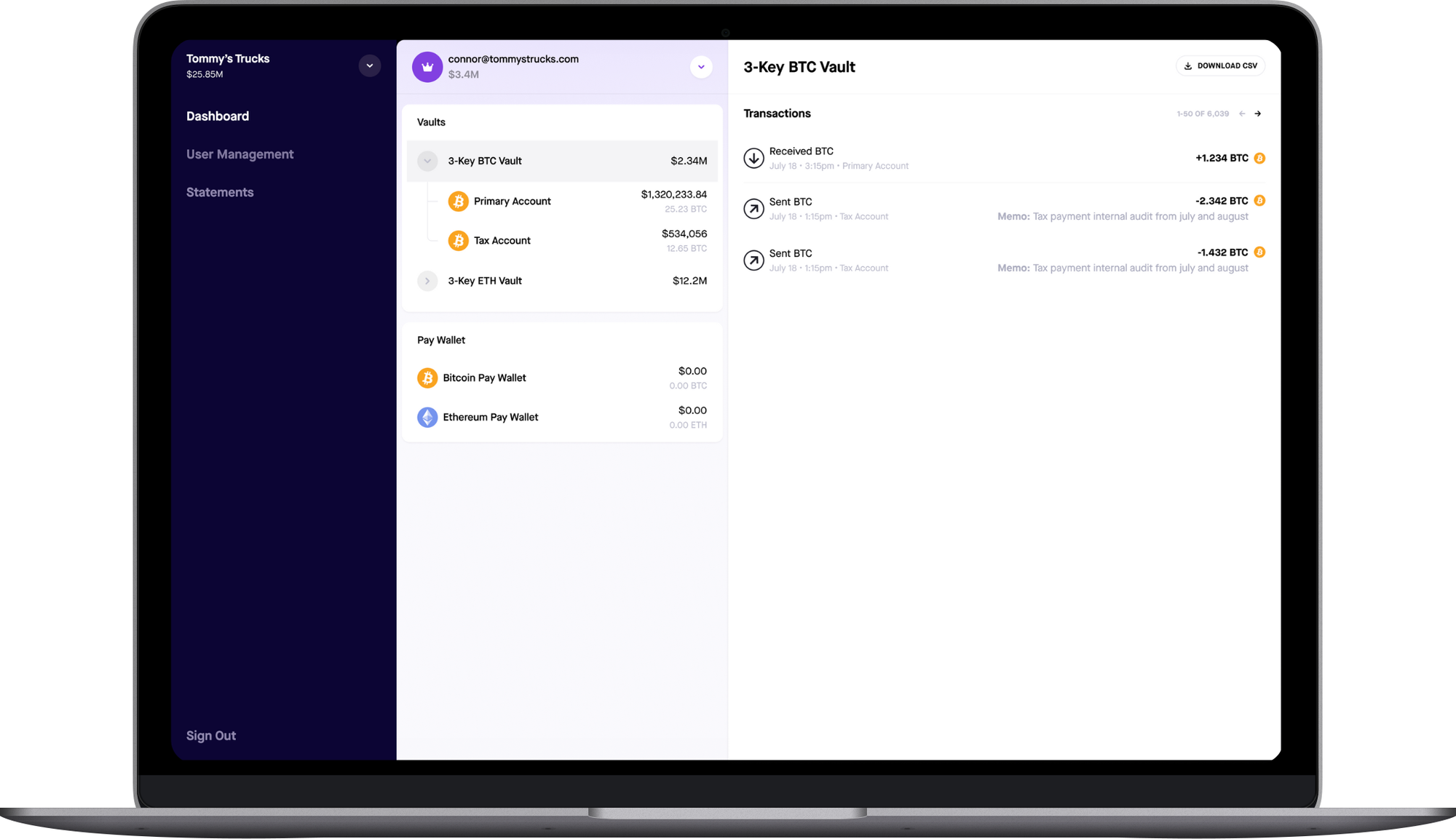

Provide transparency with a web-based dashboard

Accounting and reporting is a critical part of holding any asset. It’s not enough to have your assets locked down. You need visibility into individual transactions in real time to stay on top of taxes and internal processes.

Available on the web, our Enterprise dashboard provides you and your team with a running log of deposits and withdrawals for each of your vaults and a portal for accessing statements. You can grant and manage access to your dashboard to users with view-only access, which comes in handy for coordinating with auditors and outside accounting firms. Go as granular as you want.

Sign transactions as a team

The value of multisig is the ability to distribute keys across locations for redundancy. Casa makes it simple for you to coordinate a transaction across a team with different parties holding keys. Team signing is a much-needed option for every organization, especially those with remote staff, multiple offices, or different jurisdictions.

Our interface provides you with a smooth guide you can use to keep track of key assignments, device types, and health checks. This transparency helps you and other stakeholders feel comfortable managing your vault on a day-to-day basis.

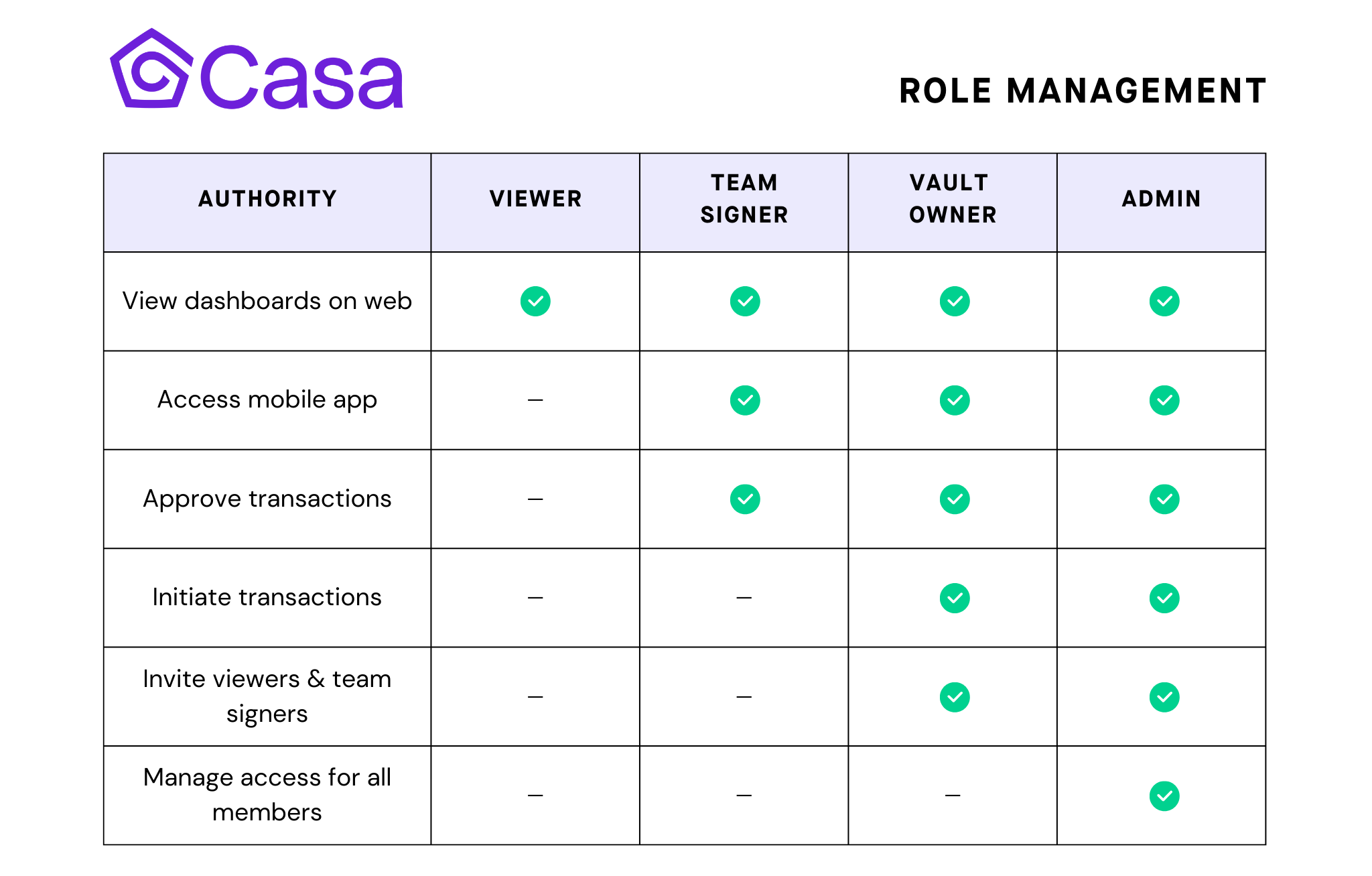

Maintain corporate governance and internal controls

We’ve seen far too many custodians lose funds through internal collusion and mismanagement. It’s neither secure nor sustainable to have one point person overseeing your assets in self-custody. Through Casa, you can invite other members of your organization and outside partners to help monitor and facilitate transactions.

You can equip users with different roles and responsibilities and adjust this access as you see fit.

Enjoy flexibility with multiple vaults and subaccounts

Managing bitcoin for different purposes? With Casa, you can hold separate assets in distinct vaults and subaccounts. This prevents commingling and helps with recordkeeping.

Start with a single-key wallet for small amounts you actively spend from to cover business expenses. Step up to a 3-key vault for operating capital. Keep the bulk of your long-term holdings in a 5-key vault. When you need to transfer between vaults, you can easily do so within the Casa app. It’s simple treasury management that has been the standard for centuries, now with the ability for you to maintain full control and benefit from bitcoin as a treasury asset.

Closing thoughts

Bitcoin has helped individuals become more sovereign in their daily lives. It was only a matter of time before it did the same for businesses. Casa Enterprise gives your team the tools to secure and manage a bitcoin treasury. You’re in good company.

Start your bitcoin treasury with a secure foundation

Want to start holding bitcoin but not sure where to begin? Our enterprise security playbook gives you a roadmap for how to tailor self-custody to your business, incorporate into your workflows, and implement the necessary controls to protect your assets. Download it below for free.

By entering your email, you agree to receive marketing communications from us. You can unsubscribe at any time.