Protect your stablecoins: Hold USDC and USDT with Casa

Imagine a world where your bank is available 24/7.

We’re not talking about a world where you send a mobile app payment and it finally reaches the other person’s account two days later. We’re talking about real, always-on, instant access to your wealth.

In this world, your money would be just as online as you are. You could send payments whenever and wherever you want without relying on a bank. And you wouldn’t have to worry about your money being caught up in a banking crisis. Your money would be fast, instant, and available to you and you alone. You secure it, you control it.

Today, we’re happy to share that world is one more step closer to a reality. You can now hold two stablecoins within a Casa vault: Tether (USDT) and USD Coin (USDC). This makes Casa a comprehensive, self-custodial vault for bitcoin, ethereum, and dollar-pegged stablecoins.

What are stablecoins?

Stablecoins are tokenized assets on ethereum and other blockchains that are pegged to fiat currency reserves (typically U.S. dollars) maintained by the issuer. Because stablecoins exist on crypto infrastructure, they allow for peer-to-peer transactions with nearly instant settlement and no third-party companies or financial institutions required to process the transaction.

Why secure stablecoins with Casa? Multiple keys means better security.

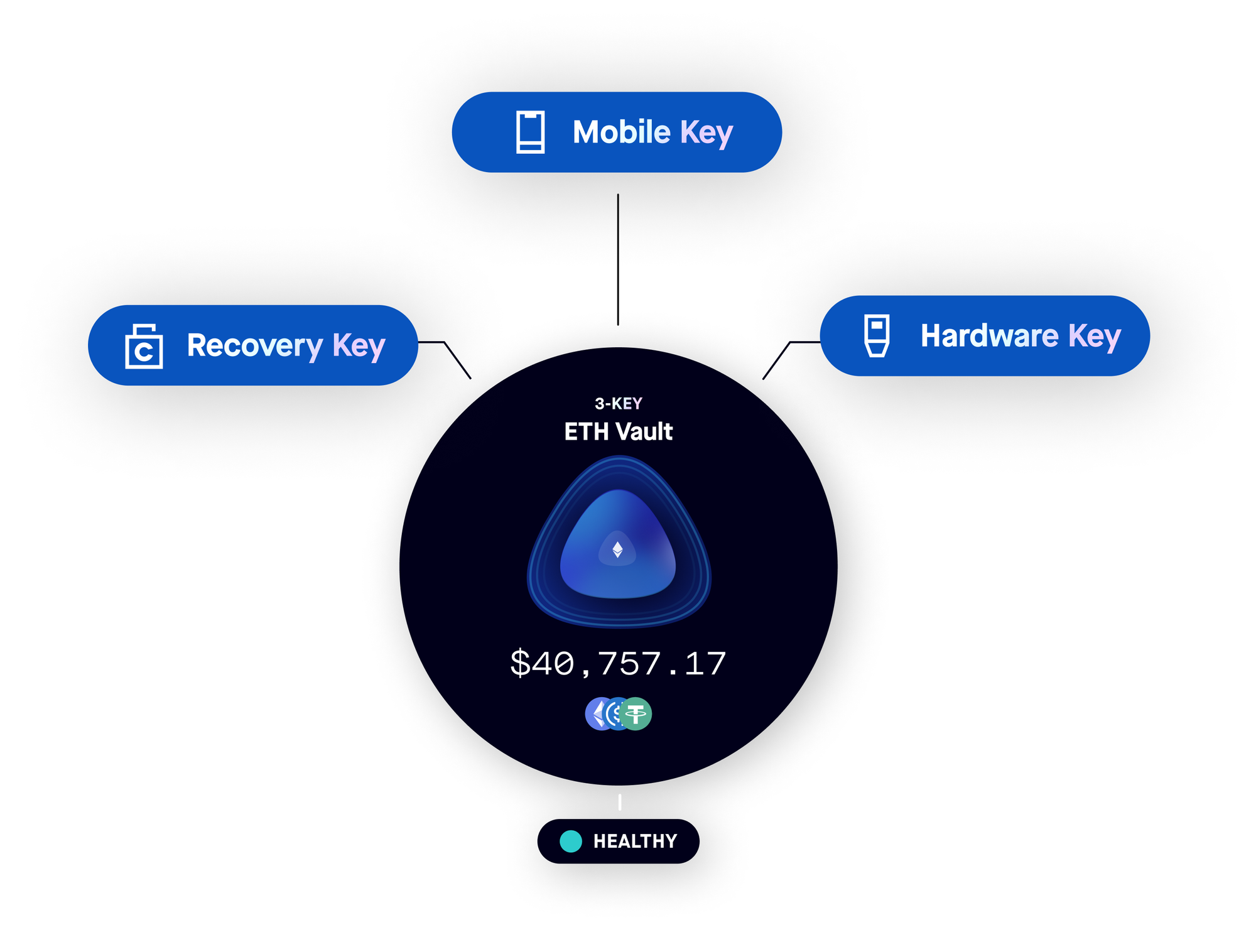

Casa helps you hold your digital assets without fear of loss or theft. Casa vaults are built with multiple keys (multisig), so if you lose a key, you don’t lose all your assets.

Casa’s technology uses a mix of hardware wallets like Ledger, Trezor, Coldcard, and mobile phones to secure your vault. These devices, or keys, are used to send and receive assets within that vault.

A Casa Standard membership comes with a 3-key vault, which requires you to approve a transaction with two keys to send assets. For instance, you could use your phone as key #1 and a hardware wallet as key #2 to sign a transaction. If you lose one of those devices, you can use our Casa Recovery Key, an emergency key we hold on your behalf. This allows you to have peace of mind that even if something were to happen to one of your devices, your assets are still safe and able to be recovered.

Casa can transform your phone or hardware device into a high-security vault to store all of your bitcoin, stablecoins (USDT and USDC), and ethereum. Never worry again about getting locked out of bank accounts, theft, hacks, and third-party failures, like crypto exchanges going bankrupt.

Self-custody reimagined

For ages, everyday people have had a complex and tenuous relationship with banks and financial institutions. Before the advent of bitcoin, we were heavily dependent on banks to safeguard our wealth. These institutions frequently took that trust for granted with questionable lending practices and chronic mismanagement.

Even for digital assets, it’s all too common for people to purchase them and leave them in the care of a “trusted” custodian or exchange, often with unfortunate consequences.

Until recently, you couldn’t escape these trusted systems and hold your assets yourself without shouldering security risks. But now, thanks to the invention of bitcoin, we have moved past storing “money in the mattress.” With a well-distributed Casa vault, you can hold bitcoin and USD stablecoins and transcend the financial system of yesterday with self-custody.

Maintain your own savings

The traditional banking system operates with fractional reserves. This policy allows a bank to hold only some of the money you deposit in your account and lend out the rest. This arrangement encourages economic activity, among other purposes, but it also increases the likelihood that one or more institutions will fail with a bank run.

This system defeats the purpose of saving money, which is to keep it for when you need it. What’s the point in saving if you give your money to someone who turns around and lends it out, especially if you don’t get paid any interest on your deposit?

Casa vaults give power back to you, the depositor, and allow you to manage your own savings securely.

Greater resilience against geopolitical instability

Digital assets exist on a spectrum of risk and resilience against varying threats. Bitcoin offers some resilience over fiat currency reserves and jurisdictional risks whereas stablecoins can provide some resilience against individual institutions and volatility with bitcoin itself. Today, even the most passionate crypto investors still use dollars and other government-backed currencies on a daily basis, and investors around the world use stablecoins to hold their wealth.

There is also merit to securing fiat reserves with crypto technology. For those in countries with weak or failing currencies, dollar-pegged stablecoins provide a way to benefit from the stability of the U.S. dollar relative to other currencies. In recent years, we’ve unfortunately seen inflationary crises and bank failures emerge in many nations, and you don’t have to be another victim.

In more U.S. dollar-integrated nations, holding stablecoins in self-custody could provide a useful hedge in the event of a financial crisis. Because you can transact peer-to-peer, you retain the ability to participate in the broader crypto ecosystem that knows no banking hours.

Casa is a robust, flexible solution for holding dollar-pegged stablecoins wherever you are in the world.

Final thoughts

Today, being your own bank is more than a meme. You can take a major step with multiple keys for resilience while maintaining autonomy and control of your stablecoins with Casa.

Already have a hardware wallet? Create your vault now.

It’s super easy to set up your own 3-key vault. Our Standard membership comes with a self-guided onboarding where we add two keys to your existing hardware wallet. This protects your assets so one hack or accident doesn’t mean lost assets.

Get started here.